Walk past any leisure centre in Britain and you might spot something new: glass-walled courts filled with players wielding short rackets, the distinctive pop of a ball ricocheting off walls. Padel has arrived. What began as a niche import from Spain has become the fastest-growing sport in the UK, with courts springing up from London to Edinburgh at a rate that has surprised even the most optimistic investors.

The Spanish Export That Conquered Britain

Padel was invented in Mexico in 1969, but Spain turned it into a phenomenon. By 2020, Spain had over 20,000 courts and four million regular players. Britain, by contrast, had fewer than 50 courts. Fast forward to 2025 and the UK boasts more than 400 courts, with another 200 planned for construction this year.

The sport crossed the Channel in earnest around 2019, brought by British expats who had played in Spain and wanted to recreate the experience at home. Early adopters built courts in London suburbs like Chiswick and Ealing. Word spread quickly. The format was simple: doubles only, played on a court one-third the size of a tennis court, enclosed by glass walls that keep the ball in play. Players could rally within minutes of picking up a racket.

Tennis champion Andy Murray spotted the opportunity early. In 2021, he invested in Game4Padel, a UK operator planning to open dozens of courts nationwide. His involvement brought mainstream attention. Other investors followed, pouring millions into new facilities. The British padel map transformed from a handful of dots to a sprawling network covering most major cities.

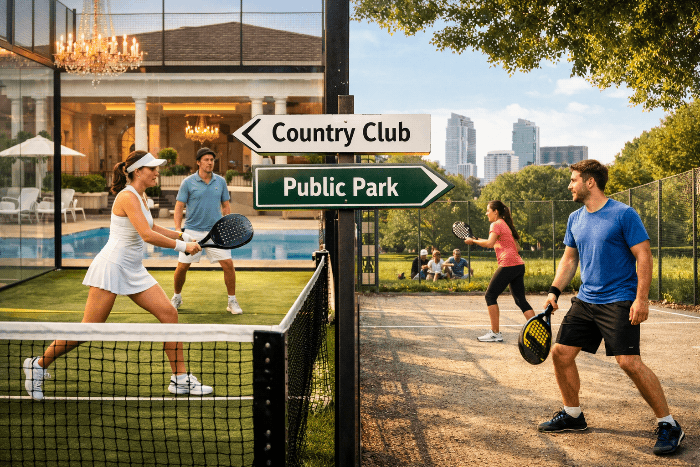

Why Britain Fell for a Spanish Sport

Padel's growth in Britain wasn't accidental. The sport solved problems that had long plagued British racket sports. Tennis required years of practice before players could sustain a decent rally. Squash demanded brutal fitness levels. Padel offered something different: instant gratification.

Beginners could play proper games within their first hour on court. The smaller court meant less running. The walls kept the ball in play, creating longer rallies. Mixed-ability groups could compete without frustration. A 25-year-old athlete could play alongside their 55-year-old parent, and both would enjoy themselves.

The doubles-only format created a social atmosphere that tennis struggled to match. Players rotated partners, chatted between points, and often headed to the bar afterwards. Clubs reported that 40% of their bookings came from the same groups playing weekly. Padel wasn't just exercise; it was a social event with guaranteed entertainment.

Weather presented an unexpected advantage. Most UK courts were built outdoors but with covered roofs, creating a middle ground between indoor squash courts and exposed tennis courts. Players stayed dry but enjoyed fresh air. British weather, famous for ruining tennis matches, barely interrupted padel sessions.

The Numbers Tell the Story

Data from the Lawn Tennis Association shows padel participation grew by 176% between 2022 and 2024. That's faster growth than any other sport measured in the UK during the same period. The number of registered padel players jumped from 6,000 to over 45,000. Unofficial estimates suggest the real number of regular players has already passed 100,000.

Court construction tells a similar story. Developers built 120 new courts in 2023 alone. The average cost of building a single court runs between £25,000 and £40,000, depending on surface quality and location. Despite the expense, waiting lists for court time at popular clubs can stretch to three weeks.

London leads the charge with over 150 courts, but regional cities have caught up quickly. Manchester now has 35 courts, Edinburgh has 18, and Birmingham has 22. Even smaller towns like Swindon and Exeter have multiple facilities. The demographic spread is unusually broad: 60% of players are between 25 and 45, but a growing number are over 50.

Corporate Britain Discovers Padel

Business culture has embraced padel faster than golf. Companies book courts for team-building events, client entertainment, and networking sessions. The format works brilliantly for corporate groups: everyone can participate regardless of fitness level, sessions last 90 minutes, and the social aspect encourages conversation.

Legal firms in the City of London now organise monthly padel leagues instead of golf days. Tech startups host recruitment events on court. Estate agents in Surrey use padel mornings to entertain potential clients. The shift reflects broader changes in British business culture: younger professionals prefer active, time-efficient networking over long golf rounds.

David Chen, who runs a consultancy in Manchester, switched from golf to padel for client entertainment two years ago. "Golf takes five hours and excludes half my clients who don't play," he says. "Padel takes 90 minutes, everyone can join in, and we're back in the office by lunch." His firm now books courts twice a week.

The Infrastructure Boom

Property developers have spotted padel's potential. Luxury apartment blocks in London and Manchester now include padel courts as standard amenities, alongside gyms and pools. David Lloyd Clubs, one of Britain's largest leisure operators, has added padel courts to 40 of its sites. Virgin Active and Nuffield Health followed suit.

Standalone padel centres have emerged as profitable businesses. Padel clubs charge between £30 and £50 per court per hour, split between four players. Popular venues book out their courts seven days a week. The maths works: a four-court facility running at 70% capacity generates over £400,000 in annual revenue before coaching fees and bar sales.

Some operators have taken ambitious approaches. Game4Padel opened a 12-court facility in Trafford Park, Manchester, complete with a restaurant and bar. The Padel Club in Ealing runs leagues with over 200 members. We Are Padel operates sites in Bath, Cardiff, and Bristol, targeting regional cities before competition intensifies.

Challenges on the Horizon

Rapid growth brings problems. Court quality varies wildly. Some clubs use premium glass and professional-grade artificial turf; others cut corners with cheaper materials that wear out quickly. Players complain about inconsistent surfaces affecting ball bounce and making the game less enjoyable.

Coaching standards remain patchy. Spain produces qualified padel coaches through structured programmes, but Britain lacks equivalent training systems. Many UK coaches learned the sport recently and teach mixed techniques from tennis and squash. The Lawn Tennis Association has started certifying padel coaches, but demand outstrips supply.

Oversaturation looms in some markets. Central London now has so many courts that prices have started dropping. Clubs that charged £50 per hour in 2023 now charge £35 to fill slots. Smaller operators struggle to compete with chains that can absorb losses while building market share.

Planning permission creates bottlenecks. Local councils receive complaints about noise from glass walls amplifying the sound of balls striking surfaces. Some residents near new courts have launched opposition campaigns. Developers must now conduct noise assessments and install sound barriers, adding cost and complexity.

The Competition Circuit Takes Shape

British padel has developed a competitive structure faster than anyone expected. The Padel Federation of Great Britain now oversees national rankings and tournaments. Regional leagues operate in London, Manchester, Birmingham, and Edinburgh. Prize money remains modest compared to tennis, but professional players can earn £20,000 to £40,000 annually from tournaments and coaching.

British players still lag behind Spanish and Argentine competitors, but the gap is closing. Several UK-based players now compete on the World Padel Tour, the sport's premier circuit. Tom Murray (no relation to Andy) reached a tour quarterfinal in 2024, the best result by a British player.

Youth programmes are expanding quickly. Schools in Surrey, Hampshire, and Berkshire have added padel to their sports curricula. The sport's easier learning curve compared to tennis makes it popular with children who struggle with traditional racket sports. Junior participation tripled between 2023 and 2024.

What Comes Next

Industry insiders predict continued growth but at a slower pace. The UK will likely have 800 to 1,000 courts by 2027, approaching a saturation point in major cities. Growth will shift to smaller towns and rural areas where tennis clubs convert unused courts to padel.

Television coverage could accelerate mainstream adoption. Sky Sports broadcast World Padel Tour events in 2024, introducing millions of viewers to the sport. Viewing figures remain modest, but they're growing. Sponsors are paying attention: Adidas, Head, and Wilson now produce dedicated padel equipment lines for the UK market.

Technology is entering the game. Some premium clubs use digital booking systems that track playing frequency and skill levels, automatically creating balanced matches. Coaching apps analyse video footage and suggest improvements. These tools could help British players close the gap with established padel nations.

The sport's future depends partly on retaining current players. Early enthusiasm can fade when people reach intermediate level and improvement slows. Clubs must offer varied programming—leagues, social sessions, coaching—to keep members engaged. The businesses that master this will survive the inevitable shakeout when growth plateaus.

From Fad to Fixture

Padel's trajectory in Britain suggests it has moved beyond novelty status. The infrastructure is real: hundreds of courts, thousands of regular players, professional coaching, competitive leagues. Investment continues to flow. Major leisure operators are committed.

Comparisons to previous sports fads miss the mark. Beach volleyball never built lasting infrastructure. Pickleball remains niche. Padel has attracted serious money and created sustainable business models. Courts generate revenue, clubs turn profits, and players keep coming back.

Britain won't match Spain's padel obsession anytime soon. Spanish courts outnumber British courts fifty to one. But the UK has reached a tipping point where the sport is self-sustaining. New players can find courts nearby, book easily, and join established communities.

What started as a Spanish export has become a permanent feature of British leisure culture. Suburbia has glass-walled courts now, and they're not going away. The fastest-growing sport in Britain has arrived, and it's here to stay.